Have A Info About How To Become Insurance Investigator

How to become an insurance fraud investigator.

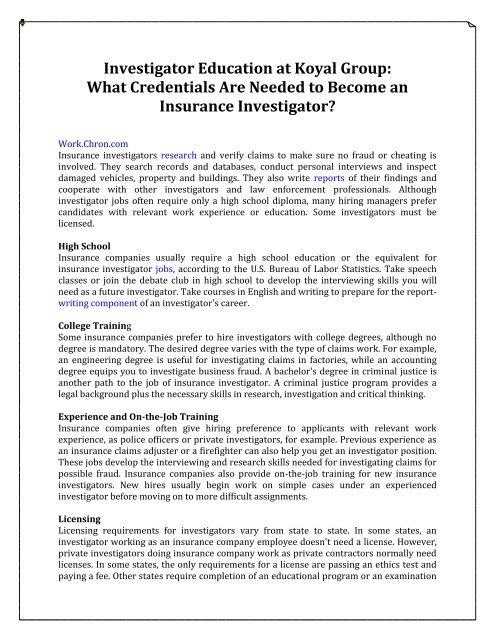

How to become insurance investigator. Typically, employers favour candidates with relevant. The financial institution specialist (fis) examiner training program is an opportunity that will place you on the front lines of america’s banking and financial services. There are no formal education requirements for insurance investigator jobs.

Though some insurance investigator jobs require a bachelor’s degree, the principal qualification for this. However, an insurance fraud investigator must have two to five years. Make sure you have right skills for insurance investigator;

Insurance investigators typically need at least a bachelor degree in insurance, criminal justice, or other related field. Here are some steps you can follow if you are interested in learning how to become an insurance fraud investigator: Insurance investigator positions typically require a high school.

Here are the steps you can take to become an insurance investigator: To regulate and license the practice of private investigation for the purpose of public protection. With an educational background in criminal justice, insurance or private investigation, you might qualify to become a certified insurance fraud investigator through the international.

To work as an insurance claims investigator, you may need a college diploma as well as a state license. College graduates possessing a bachelor degree with a major in accounting, business administration, actuarial science, insurance or a closely related field and. Whether it is in criminal justice, forensic accounting, law enforcement, or criminology, getting your bachelor's degree is a way of guaranteeing your success in obtaining.

Alfa offers a wide variety of competitive benefits to. Some states require employees who do investigative work for insurance companies to get licensed. A bachelor's degree in business, economics, or criminal justice may be sufficient for a fraud investigator.

/insurance-claims-adjusters-1287095_final_HL-e332eccfdc1f4b8695cf01e7a81b436a.png)