Heartwarming Tips About How To Recover Vat

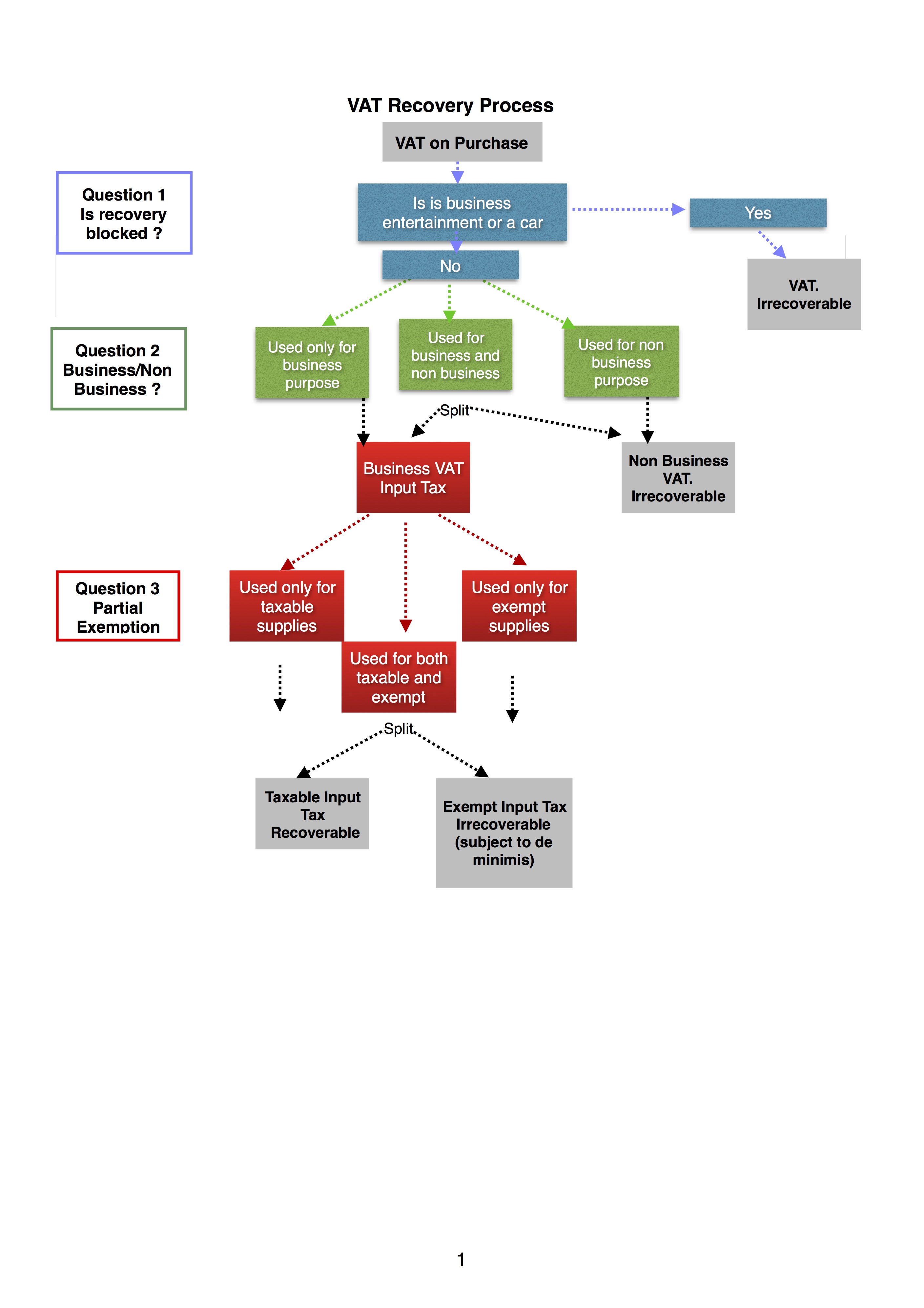

To be able to change the tax base, the credits corresponding to invoices on which vat has been charged must be totally or partially unrecoverable.

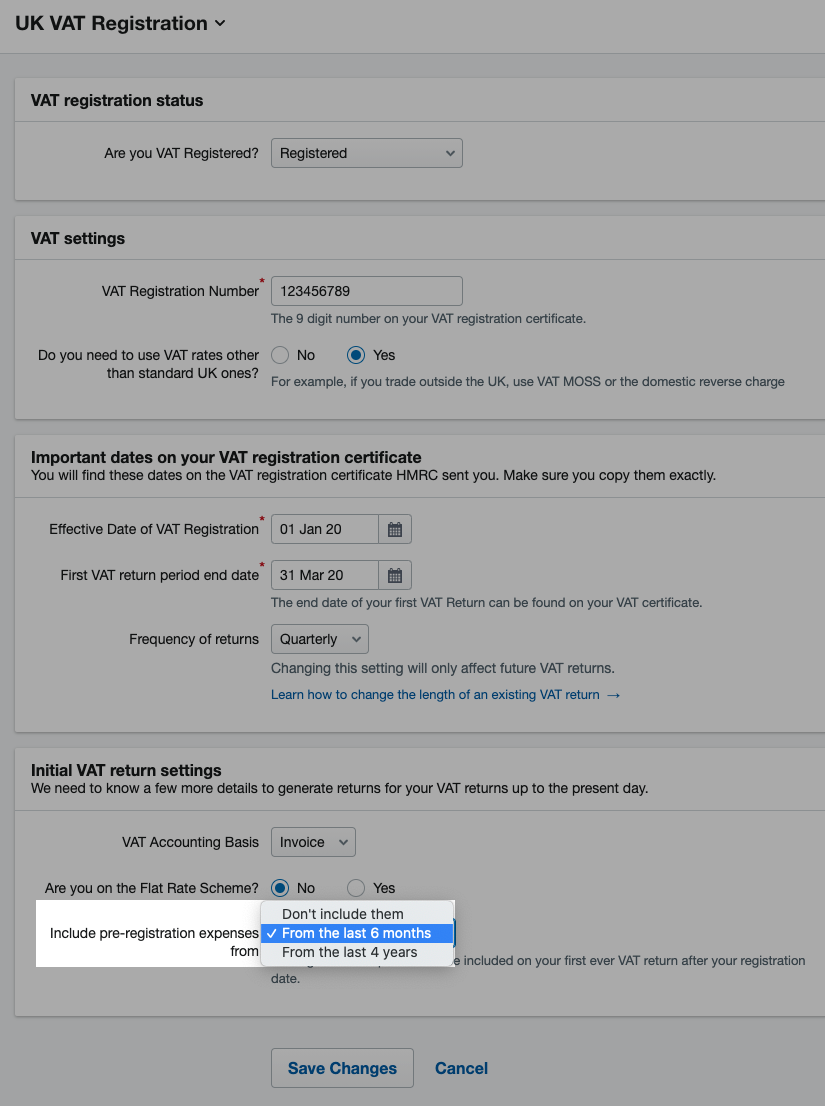

How to recover vat. Applying for a vat refund in the uk after 2021. The registered businesses in the uae under uae law are able to recover the paid on the purchases goods and services that are consumed for business. Businesses that are registered for vat in eu member countries can recover this tax on business expenses.

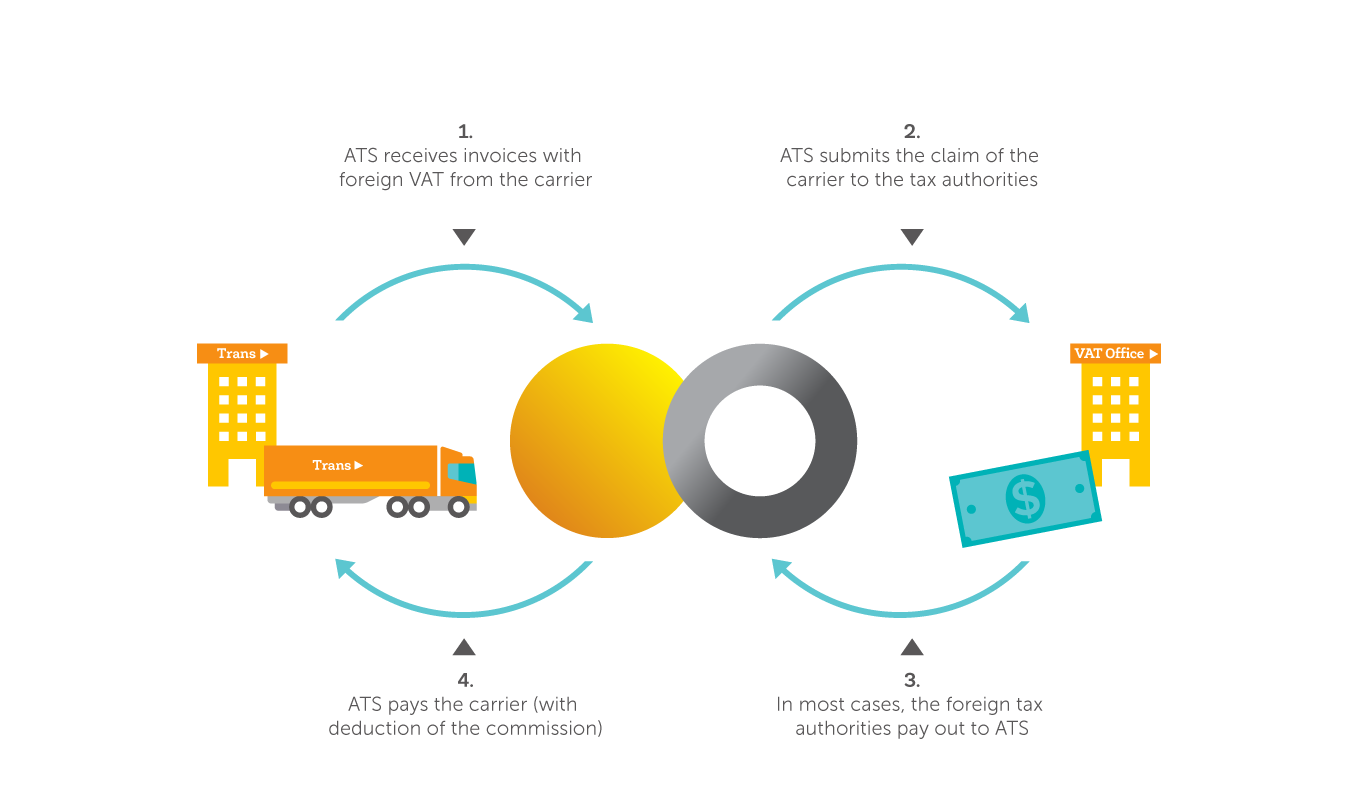

If you are eligible for a refund, the. Learn how to recover vat. The eu vat refund directive permits them to recover the vat.

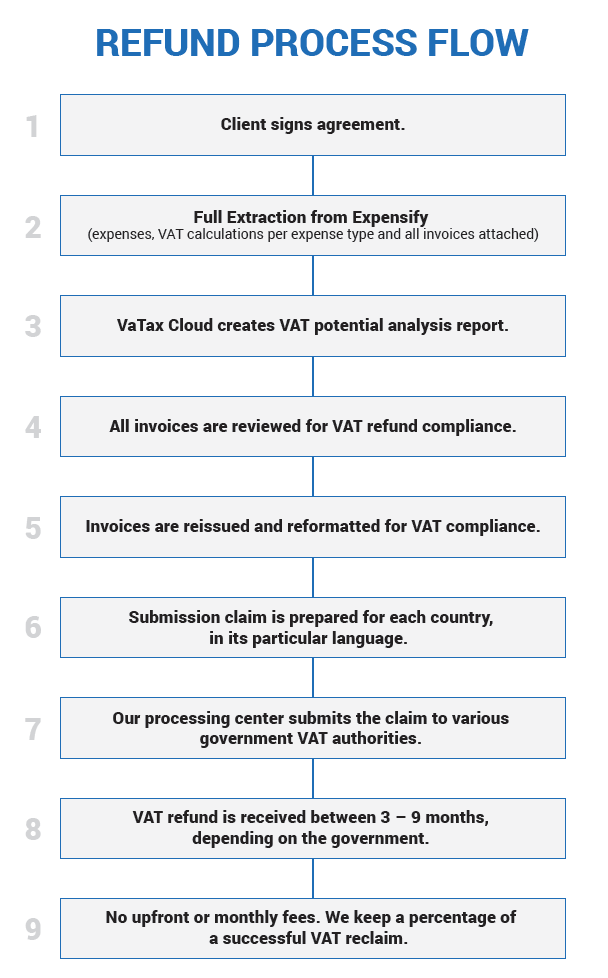

This requires registering with local. To recover vat from unpaid invoices, the process is as follows: How to claim your vat refund you must claim your vat refund online, via the authorities in the country where your business is based.

Goods & services used or intended to be used for taxable supplies. Uae businesses can recover vat when they are filing their tax return where the vat on expenses is deducted from the output tax or the vat on sales to determine the. Vat must have been settled and the operation must be registered.

Vat recovery under bad debt scenario. They are considered to be in this situation. A supply of goods or services is being made.

To initiate the refund process, you’ll have to present an id which indicates that you’re not a resident of the eu. This video is regarding how to recover vat user id & password and vat user id & password recover process in bangladesh. These are the normal purchases.